The board is ultimately responsible for ensuring that the Company has an appropriate risk management framework to identify and manage risks.

The board is also responsible for determining the following in relation to the investigation of a Whistleblower Report:

The board will determine any actions required arising from Whistleblower Reports and the findings of investigations into Whistleblower Reports.

MD is responsible for:

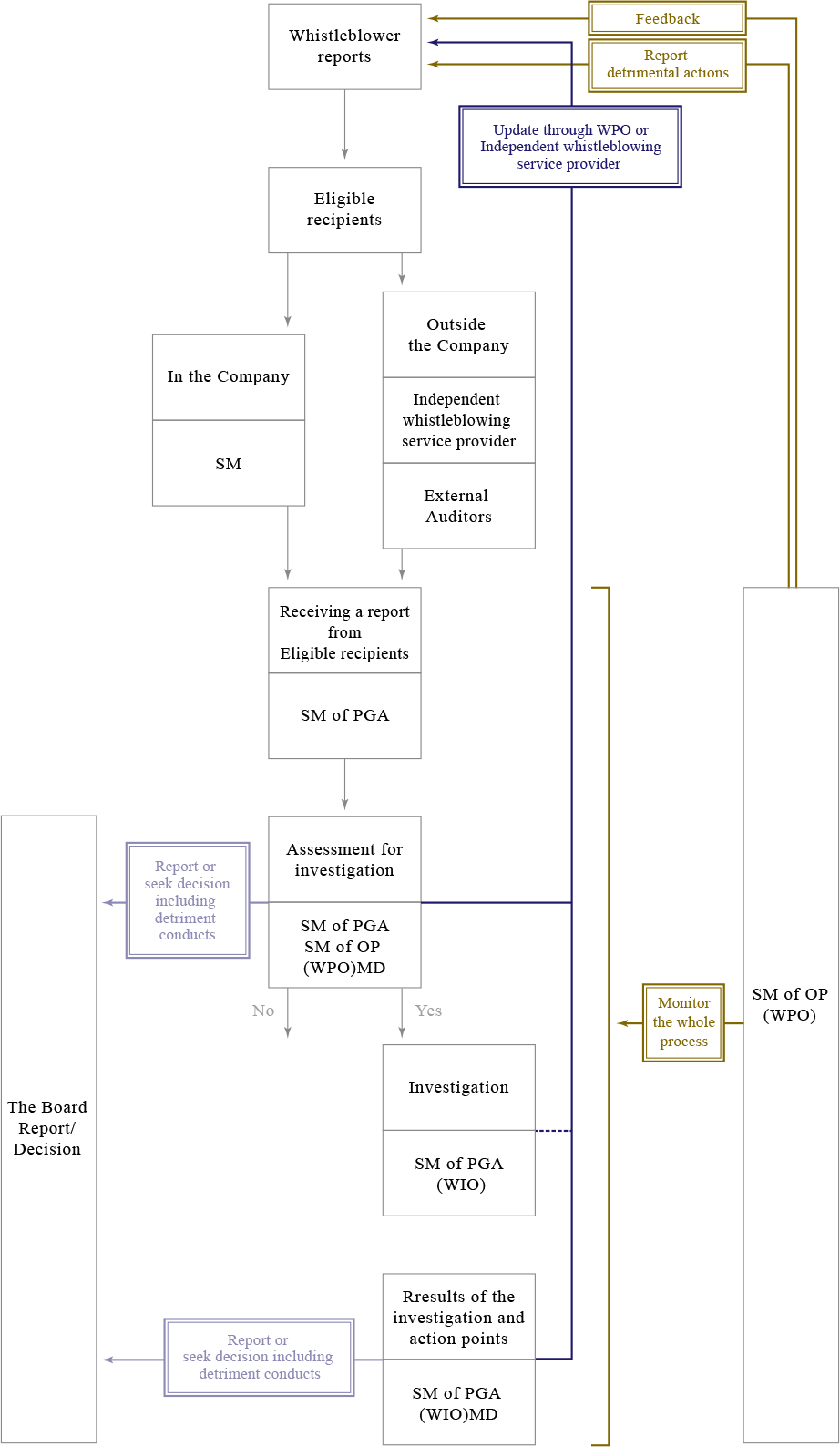

SM is responsible for receiving Whistleblower Reports as an Eligible Recipient.

SM of PGA acts as WIO and an Eligible Recipient.

SM of PGA receives reports sent by Eligible Recipients.

SM of PGA as WIO is responsible to

SM of PGA is also responsible for reviewing and updating the Policy.

SM of OP acts as WPO and an Eligible Recipient.

SM of OP as WPO is responsible to

The Policy applies to all individuals who are or have been:

(Eligible Whistleblower).

Eligible Whistleblowers are eligible for protection under law and the Policy provided:

For the purpose of he Policy, the matters that must be reported to the Company are suspected misconduct or an improper state of affairs (Reportable Conduct).

Misconduct means fraud, negligence, default, breach of trust and breach of duty.

Reportable Conduct includes (without limitation):

Reportable Conduct includes conduct that may not involve the contravention of a particular law.

Information that indicates a significant risk to public safety or the stability of, or confidence in, the financial systems is also Reportable Conduct.

Examples of Reportable Conduct include:

To make a Whistleblower Report, an Eligible Whistleblower must have reasonable grounds to suspect Reportable Conduct has occurred. This means the Eligible Whistleblower must have some basis for making a Whistleblower Report, but they do not need to prove the Reportable Conduct occurred.

An Eligible Whistleblower may still qualify for protection even if their Whistleblower Report turns out to be incorrect.

Personal work-related grievances

The Policy does not apply to reports that relate solely to personal work-related grievances, which include bullying and harassment, unless they relate to a Whistleblower Report.

Personal work-related grievances are those that relate to the discloser's current or former employment and have, or tend to have, implications for the discloser personally but do not:

Examples of personal work-related grievances include:

It should be noted that disclosures that relate solely to personal work-related grievances may be protected under other legislation, such as the Fair Work Act 2009 (Cth), and should be reported under the Company’s Employee Handbook. The Company encourages its workers to resolve personal work-related grievances including under the Company's Employee Handbook.

The Policy does not apply to customer complaints about the Company.

False reporting

The Company discourages deliberate false reporting (i.e. a report that the discloser knows to be untrue). If a person deliberately makes a false report, the Company make take disciplinary action up to and including termination of their employment or engagement.

An Eligible Whistleblower may make Whistleblower Reports to the following recipients defined as 'Eligible Recipients' to qualify for protection (and the Company's preferred Eligible Recipients are the first three recipients listed at (a) to (c)):

Importantly, if the Eligible Whistleblower does not make a Whistleblower Report to an Eligible Recipient, they will not qualify for protection.

If an Eligible Whistleblower would like to seek additional information before formally making their disclosure, the Eligible Whistleblower may contact the Independent whistleblowing service, provided by Deloitte.

Nothing in the Policy should be taken as restricting an Eligible Whistleblower from making a report to a regulator (such as Australian Securities and Investments Commission, Australian Prudential Regulatory Authority or the Australian Taxation Office), or a legal practitioner for legal advice or under certain circumstances a journalist or parliamentarian in accordance with any relevant law or regulation (detailed below). The Company however encourages Eligible Whistleblowers to first make a Whistleblower Report to the Independent whistleblowing service provider or another Eligible Recipient. The Company would like to identify and address wrongdoing as early as possible. The Company's approach is intended to help build confidence and trust in the Company's Policy, internal process and internal procedure.

Legal practitioners

An Eligible Whistleblower may make a Whistleblower Report to a legal practitioner for the purpose of obtaining legal advice or legal representation in relation to the operation of the whistleblower provisions of the Corporations Act. In these circumstances, a disclosure made to a legal practitioner will qualify for protection.

Regulatory bodies and other external parties

An Eligible Whistleblower may make a Whistleblower report to the following regulatory bodies and qualify for protection:

Each regulatory body provides information about whistleblowing information at the following links.

Public interest disclosure and emergency disclosures

Eligible Whistleblowers may also make Whistleblower Reports to journalists or a member of parliament and qualify for protection if (and only if) the Whistleblower Report is either a public interest disclosure or an emergency disclosure.

A public interest disclosure is the disclosure of information to a journalist or a member of parliament where the following conditions are met.

An emergency disclosure is the disclosure of information to a journalist or a member of parliament where the following conditions are met.

It is important to understand the conditions that must be met to make a public interest disclosure or an emergency disclosure to qualify for protection under the Corporations Act. If the conditions are not met, the Eligible Whistleblower will not qualify for protection under the Corporations Act. If an Eligible Whistleblower is considering making a public interest disclosure or an emergency disclosure, they should contact an independent legal adviser before making such a disclosure.

Making a Whistleblower Report to the Independent whistleblowing service, provided by Deloitte

The Independent whistleblowing service provider is an independent, external and confidential reporting channel with staff that are fully trained in handling sensitive and confidential reports of this nature and is the Company’s preferred channel for receiving Whistleblower reports. The Independent whistleblowing service provider is available anytime through the following channels.

Eligible Whistleblowers can remain anonymous if they wish and their identity will be protected in accordance with the Policy at all stages of the process, starting from their initial report and continuing through any investigation that takes place.

The Company does however encourage Eligible Whistleblowers to disclose their identity so that the Company can better monitor their wellbeing and protect them against detrimental action. It could also help the Company to obtain further information from the Eligible Whistleblower, should this be required. The Eligible Whistleblower’s details will however remain confidential at all times. Refer to Section 8 of the Policy for further information regarding anonymity and confidentiality of Eligible Whistleblower information.

Making a Whistleblower Report to a Senior Manager, auditor, member of the audit team or Officer of the Company

If an Eligible Whistleblower elects to make a Whistleblower Report to an Eligible Recipient, other than the Independent whistleblowing service, they may do so by sending the Eligible Recipient an email at their Norinchukin Australia’s email address.

If a Whistleblower report is made to an Eligible Recipient, other than the Independent whistleblowing service, the Eligible Recipient will forward the report to SM of PGA.

Whistleblower reports should include, to the extent possible, specific information such as dates, places, persons, witnesses, and amounts in order for the Company to consider next steps.

All Whistleblower reports made under the Policy are treated seriously and the Company is committed to ensuring that anyone making a Whistleblower Report will not suffer detrimental action. An Eligible Whistleblower will still qualify for protection under the Policy even if their report is incorrect.

The Company understands that an Eligible Whistleblower may be worried about detrimental action. For every Whistleblower report received, the SM of OP will act as the WPO and will assess the risk of detrimental action to the Eligible Whistleblower and will take appropriate actions to provide protection.

No detrimental action will be taken by the Company against an Eligible Whistleblower in relation to a Whistleblower Report whether substantiated or not substantiated by any subsequent investigation (provided it is not a deliberate false report).

Detrimental action includes:

The WPO may also be assigned to monitor the welfare of an Eligible Whistleblower, receive reports of actual or threatened detrimental action and provide feedback on the progress and results of the investigation.

Anonymity

Eligible Whistleblowers can choose to remain anonymous whilst making a Whistleblower Report, over the course of the investigation and/or after the investigation is finalised. However, the Company encourages them to disclose their identity. This will help the Company to monitor the Eligible Whistleblowers’ welfare and protect them against detrimental action.

If the Eligible Whistleblower elects to make a Whistleblower Report anonymously, they will still qualify for protection under the Corporations Act.

To protect the Eligible Whistleblower's anonymity, some of the steps the Company may take include the following:

An Eligible Whistleblower may refuse to answer questions that they feel could reveal their identify at any time, including during follow-up conversations.

The Company suggests that an Eligible Whistleblower who wishes to remain anonymous should maintain ongoing two-way communication with the Company so the Company can ask follow-up questions or provide feedback.

Confidentiality

Whistleblower Reports will be treated confidentially by the Company unless agreed otherwise. To treat reports confidentially means that the Company will not disclose the identity of an Eligible Whistleblower or information that is likely to lead to the identification of the Eligible Whistleblower. The Company will treat confidentially information that it obtained directly or indirectly because the Eligible Whistleblower made a disclosure that qualifies for protection.

To maintain confidentiality, the Company will ensure that:

Practically and despite the steps taken by the Company to maintain confidentiality, an Eligible Whistleblower must be aware that people may be able to guess the Eligible Whistleblower's identity if:

An Eligible Whistleblower’s identity will not be disclosed to anyone else unless:

The Company may disclose information contained in the disclosure with or without the Eligible Whistleblower's consent if:

It is illegal for a person to identify an Eligible Whistleblower, or disclose information that is likely to lead to the identification of the Eligible Whistleblower (unless the identification or disclosure of information falls within an exception). If a person identifies an Eligible Whistleblower or discloses information that is likely to lead to the identification of the Eligible Whistleblower, the Eligible Whistleblower can lodge a complaint with the Company about a breach of confidentiality. The Eligible Whistleblower can also lodge a complaint with ASIC, APRA or the ATO. However, the Company encourages the Eligible Whistleblower to first make a complaint with the Company so the Company can act quickly to resolve the complaint.

Once a Whistleblower report has been received, the Eligible Recipient will send a disclosure report to SM of PGA. SM of PGA will report the disclosure report to MD

The MD will be responsible for assessing whether the matter will be handled under the Policy or whether it will be handled as a personal work-related grievance. The MD will review the disclosure report, assess the risk of detrimental action to the Eligible Whistleblower. The MD will report the disclosure report to the board and seek an approval of what further action, such as a formal investigation, is required. The board will then determine:

How the Whistleblower Report will be investigated

The SM of PGA will be responsible for ensuring that all investigations are conducted in an objective and fair manner as is reasonable and appropriate having regard to the nature of the Whistleblower report and the circumstances. An investigation may be conducted using internal or external resources. Any person named in a report will be afforded procedural fairness in relation to any investigation conducted.

How the Company will keep the Eligible Whistleblower informed

Feedback will be provided within a reasonable period after receipt of a Whistleblower report if the Whistleblower can be contacted by either the Independent whistleblowing service provider or the WPO. Where possible, feedback to the Whistleblower will also be provided during and after any investigation. In some circumstances, it may not be appropriate to provide details of the outcome to the Eligible Whistleblower.

How the investigation findings will be documented, reported internally

The findings of the investigation will generally be recorded in a final, anonymised report and will be reported to the MD by SM of PGA. The MD will report the anonymised report to the board and seek an approval of the recommended action points. Whistleblower reports involving MD, SM of PGA and SM of OP will be handled with each substitute as follows.

The method for documenting and reporting the findings will depend on the nature of the disclosure.

In addition to the internal process within the Company, the Company will report within the framework of Section 7 to the Norinchukin Bank, the parent company in accordance with the policy put in place at the Norinchukin Bank.

How the Company will ensure the fair treatment of employees of the Company who are mentioned in Whistleblower Reports

Employees who are the subject of or mentioned in Whistleblower Reports will be treated fairly including that the Company will:

An Eligible Whistleblower who makes a Whistleblower Report in accordance with the Corporations Act as summarised in this Policy qualifies for whistleblower protections which are:

These protections apply to Whistleblower Reports made to Eligible Recipients, to regulatory bodies, legal practitioners and to public interest disclosures and emergency disclosures made in accordance with the Corporations Act.

Protection from detrimental acts or omissions

A person cannot:

to an Eligible Whistleblower (or another person) in relation to the Whistleblower Report if the reason for the detrimental conduct is that the person believes or suspects that the discloser made, may have made, proposes to make or could make a disclosure that qualifies for protection.

Detrimental conduct includes:

Examples of conduct that is not detrimental include:

To protect Eligible Whistleblowers from detriment, the Company may assess the risk of detriment against a discloser and this assessment will be made as soon as possible after receiving a disclosure.

If an Eligible Whistleblower believes they have suffered detriment, they may seek independent legal advice or contact ASIC, APRA or the ATO although the Company encourages disclosers to report the detrimental conduct to the Company before contacting a regulatory body.

Compensation and other remedies

If an Eligible Whistleblower suffers loss, damage or injury because of a Whistleblower Report and the Company failed to take reasonable precautions and exercise due diligence to prevent the detrimental conduct, the Eligible Whistleblower may seek compensation and other remedies through the courts.

The Company encourages disclosers to seek independent legal advice if they are considering seeking remedies through the courts.

Civil, criminal and administrative liability protection

An Eligible Whistleblower is protected from any of the following liability in relation to their Whistleblower Report:

The protections do not grant immunity for any misconduct an Eligible Whistleblower has engaged in that is revealed in their disclosure.

The Policy is available:

The Company will review and update the Policy as and when necessary but at least every two years.

(Effective Date)

This Policy shall take effect and apply as of 13 December 2019.